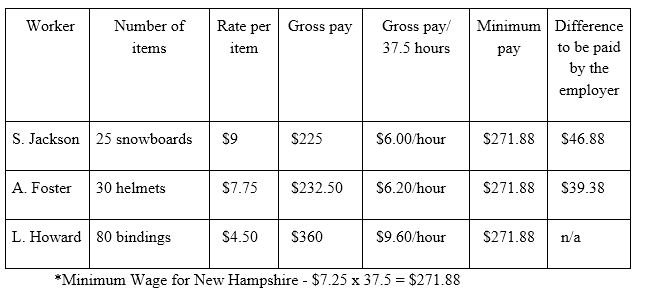

For each of the piece rate workers at Perigen Snowsports, determine gross pay. If the employees have a standard 37.5-hour workweek, determine their effective hourly rate. Based on FLSA minimum wage for New Hampshire, what is the minimum wage they must receive each week? If they are not receiving the FLSA minimum wage for the pay period, what is the difference that must be paid by the employer? (Remember: Effective hourly rate equals the gross pay divided by 37.5 hours)

What will be an ideal response?

You might also like to view...

During what period, those closest to the one who suffered the loss typically try to protect him/her by shielding him/her from feeling sad?

A. mourning B. anger C. denial D. acceptance

Complete the statement, using the following terms: increase, decrease, or have no effect on. Increases in total fixed costs________ contribution margin per unit and ________ the breakeven point.

What will be an ideal response?

Benjamin has a $15,000 Section 1231 gain from the sale of business use real estate and a $3,500 long-term capital gain from the sale of Rhyne Corporation stock. Also, he suffers an $18,000 (net of insurance reimbursements and the $100 floor) personal use property casualty loss. No net Section 1231 losses have been deducted as ordinary losses in prior years. By what amount will Benjamin's current-year adjusted gross income increase (decrease)?

A. $500 B. $3,500 C. $15,000 D. $15,800 E. $18,500

(Future tense) Logitech Industries ____ its new CEO on Monday

A) announces B) announced C) will announce