Contrast the effects of a rising price level versus a falling price level on consumption and investment.

What will be an ideal response?

Consumption entails expenditures for consumer goods and services. Investment entails purchases of investment goods. An increase in the overall price level reduces the real value of money and makes consumers poorer, encouraging them to spend less money. Thus, consumption declines. By contrast, a falling price level increases the real value of money and makes consumers wealthier, encouraging them to spend more money. Thus, consumption increases. A rising price level causes firms to hold more money to buy goods and services. They will need to borrow money. Increased demand for loanable funds will push up interest rates, which discourages investment spending. Thus, investment declines. By contrast, a falling price level means that firms need to hold less money to buy goods and services. They will shift their excess money into interest-earning assets. This will increase the supply of funds to the loanable funds market and push down interest rates. Lower interest rates will encourage investment spending. Thus, investment increases.

You might also like to view...

Starting from long-run equilibrium, a large increase in government purchases will result in a(n) ________ gap in the short-run and ________ inflation and ________ output in the long-run.

A. expansionary; higher; potential B. recessionary; higher; potential C. recessionary; lower; lower D. expansionary; higher; higher

In the above figure, total cost for this profit-maximizing monopolistically competitive firm is

A) $91,000. B) $50,000. C) $70,000. D) $72,000.

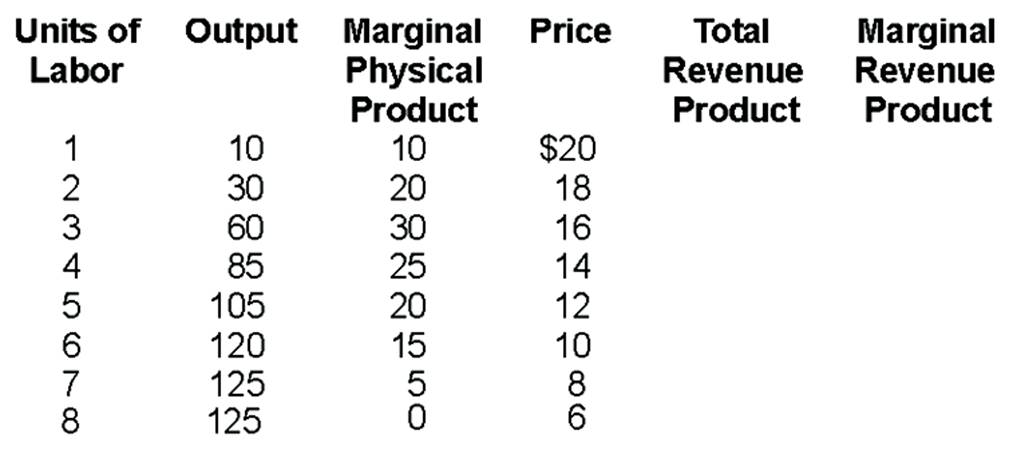

Total Revenue Product with one unit of labor would be

A. $100.

B. $200.

C. $340.

D. $600.

A decrease in supply means that:

A. the supply curve will shift to the right. B. there is a movement upward and to the right along the supply curve. C. there is a movement down and to the left along the supply curve. D. the quantity supplied at every price will decrease.