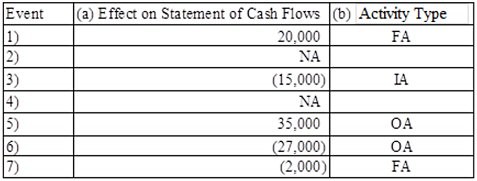

The following transactions apply to Kellogg Company.1) Issued common stock for $20,000 cash2) Provided services to customers for $38,000 on account3) Purchased land for $15,000 cash4) Incurred $29,000 of operating expenses on account5) Collected $35,000 cash from customers for services provided in event #26) Paid $27,000 on accounts payable7) Paid $2,000 dividends to stockholdersRequired:a) Identify the dollar amount effect on the statement of cash flows, if any, for each of the above transactions. b) If applicable, indicate whether each transaction involves operating, investing, or financing activities.

What will be an ideal response?

You might also like to view...

Given the following tax structure, what amount of tax would need to be assessed on Carrie to make the tax horizontally equitable? What is the minimum tax that Simon should pay to make the tax structure vertically equitable based on Fantasia's tax rate? This would result in what type of tax rate structure? TaxpayerSalaryTotal TaxFantasia20,0001,500Simon30,0002,000Carrie20,000???

What will be an ideal response?

Ethics can be a particular problem with financial reports

Indicate whether the statement is true or false

Top managers use predictive analytics to define the future of the business, analyzing markets, industries, and economies to determine the strategic direction the company must follow to remain profitable.

Answer the following statement true (T) or false (F)

Venture capitalists tend to insist on which form of incorporation for a venture because it offers multiple classes of stock?

a. LLC b. S Corporation c. C Corporation d. None of the above