Lower marginal tax rates for welfare programs will reduce the number of people on welfare.

Answer the following statement true (T) or false (F)

False

Lower marginal tax rates for welfare programs will increase the welfare rolls, making the program costlier since they are a disincentive to work.

You might also like to view...

According to the rational expectations hypothesis, an individual's assessment of future economic performance

A) considers both past performance and current monetary and fiscal policy. B) only considers past performance. C) does not consider the impact of inflation. D) does not consider past performance.

Potential GDP is the level of

A) real GDP that the economy would produce if it was at full employment. B) nominal GDP that the economy would produce if it was at full employment. C) real GDP that the economy would produce if there was no inflation. D) nominal GDP that the economy would produce if there was no inflation. E) real GDP that the economy would produce if there was no unemployment.

Which of the following is incorrect regarding financial intermediaries? a. They link savers and borrowers

b. They earn profits by loaning money. c. They offer lower interest rates on savings than they charge on loans. d. They print money. e. They accept deposits.

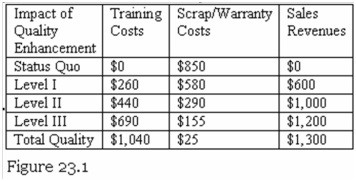

Refer to Figure 23.1. If the company moves from Level II to Level III, the additional scrap/warranty costs are:

A. $135. B. $155. C. $290. D. ?$135.