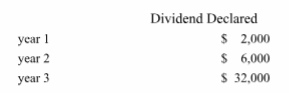

Sweet Company's outstanding stock consists of 1,000 shares of noncumulative 5% preferred stock with a $100 par value and 10,000 shares of common stock with a $10 par value. During the first three years of operation, the corporation declared and paid the following total cash dividends.

The total amount of dividends paid to preferred and common shareholders over the three-year period is:

A) $15,000 preferred; $25,000 common.

B) $11,000 preferred; $29,000 common.

C) $5,000 preferred; $35,000 common.

D) $12,000 preferred; $28,000 common.

E) $10,000 preferred; $30,000 common.

D) $12,000 preferred; $28,000 common.

Explanation: Preferred stock dividend: 1,000 shares * $100/share *5% = $5,000 per year. Year 1: $2,000 to preferred, $0 to common. Year 2: $5,000 to preferred, $1,000 to common. Year 3: $5,000 to preferred, $27,000 to common. Preferred total = $2,000 + $5,000 + $5,000 = $12,000.

Common total = $0 + $1,000 + $27,000 = $28,000.

You might also like to view...

Itemized rating scales are widely used in marketing research and form the basic components of more complex scales

Indicate whether the statement is true or false

Centrum Vitamin's offer to buy a bottle of 100 and get an extra mini-bottle of 20 free is an example of using ________ a sales promotion approach.

A. loyalty programs B. multiple-purchase offers C. product placements D. premiums E. point-of-purchase materials

A résumé summarizes information related to a job's requirements; the application message

a. adds exact details needed for processing payroll and benefits. b. summarizes how the company can benefit the applicant. c. should be omitted unless specifically requested. d. interprets the résumé in terms of employer benefits.

Which of the following prohibited non union membership as a condition to employment?

a) Sherman Act b) Railway Labor Act c) Norris LaGuardia Act d) Wagner Act e) Clayton Act