Which of the following in not a reason that a lump-sum tax imposes a minimal administrative burden on taxpayers?

a. Everyone can easily compute the amount of tax owed.

b. There is no benefit to hiring an accountant to do your taxes.

c. Everyone owes the same amount of tax, regardless of earnings.

d. The government can easily forecast tax revenues.

d

You might also like to view...

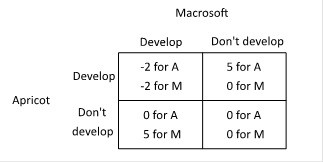

Suppose two companies, Macrosoft and Apricot, and considering whether to develop a new product, a touch-screen t-shirt. The payoffs to each of developing a touch-screen t-shirt depend upon the actions of the other, as shown in the payoff matrix below (the payoffs are given in millions of dollars).  Suppose Apricot makes its decision first, and then Macrosoft makes its decision after seeing Apricot's choice. What will be the equilibrium outcome of this game?

Suppose Apricot makes its decision first, and then Macrosoft makes its decision after seeing Apricot's choice. What will be the equilibrium outcome of this game?

A. Apricot will develop a touch-screen t-shirt, and Macrosoft will not. B. Macrosoft will develop a touch-screen t-shirt, and Apricot will not. C. Neither Apricot nor Macrosoft will develop a touch-screen t-shirt. D. Both Apricot and Macrosoft will develop a touch-screen t-shirt.

Assume that the Clean Air Act requires an increase in sulfur dioxide (SO2) abatement (A) from 50 to 60 percent and that the relevant MSC (in millions) is MSC = 12 + 0.8A, where A is measured in percent. Then, the incremental cost of this policy change is

a. $20 million b. $60 million c. $560 million d. none of the above

If the Federal Reserve wants to increase the availability of money and credit, it can:

a. lower the discount rate. b. raise the reserve requirements. c. sell U.S. government bonds to the public. d. encourage banks to increase their prime lending rate.

Policies favored by the median voter:

a. will not necessarily be the most economically efficient policies b. will likely be favored by candidates c. both of the above d. neither of the above