The internal rate of return of an investment is:

A. zero when the present value of an investment equals its cost.

B. the interest rate that equates the present value of an investment with its cost.

C. equal to the market rate of interest when an investment is made.

D. the same as return on investment.

Answer: B

You might also like to view...

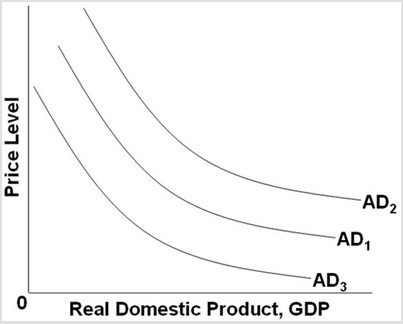

Use the following graph to answer the next question. Which of the following factors will shift AD1 to AD3?

Which of the following factors will shift AD1 to AD3?

A. A decrease in consumer wealth B. An increase in expected returns on investment C. A decrease in real interest rates D. An increase in productivity

We temporarily operated outside the production possibilities frontier for at least two years in which one of the following decades?

A. The 1930s B. The 1940s C. The 1970s D. The 1980s

Suppose a German bank purchases a U.S. Treasury bond. This transaction would be recorded in the:

A. capital account. B. current account. C. goods trade balance. D. unilateral transfers.

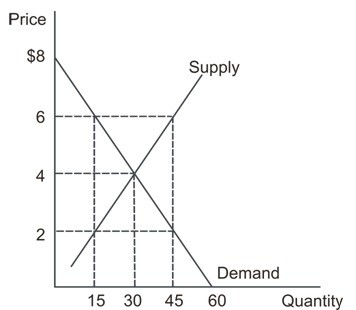

Refer to the graph shown that depicts a third-party payer market for prescription drugs. If the co-payment is $2 per pill, what will be the quantity demanded?

A. 15 B. 30 C. 60 D. 45