Economists tend to see taxing an action that produces a negative externality as:

A. the second best solution possible, but often unattainable.

B. the best solution possible and often the most attainable.

C. the best solution possible, but often unattainable.

D. the second best solution possible but one that is attainable.

Answer: D

You might also like to view...

Suppose the U.S. government encouraged new teachers to take jobs in underperforming schools by paying the new teachers a $20,000 bonus. These teachers would be exemplifying the economic idea that

A) people are rational. B) people respond to economic incentives. C) equity is more important than efficiency. D) optimal decisions are made at the margin.

The principal difference between economic profits for a monopolist and for a competitive firm is that:

a. monopoly profits create major problems of equity whereas competitive profits do not. b. competitive profits exist only in the short run whereas monopoly profits may exist in the long run as well. c. monopoly profits represent a transfer out of consumer surplus whereas competitive profits do not. d. monopoly profits are usually larger than competitive profits.

A large U.S. steel firm wants to restrict imports of Japanese steel, but Ford Motor Company wants fewer restrictions on steel so that the price of steel will go down. This can best be described as

a. a zero-sum game b. a competing-interest situation c. a special-interest situation d. a situation without widespread costs and benefits e. an argument over distribution of a public good

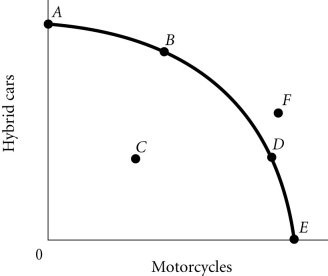

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, as the economy moves from Point A to Point E, the opportunity cost of motorcycles, measured in terms of hybrid cars

Figure 2.4According to Figure 2.4, as the economy moves from Point A to Point E, the opportunity cost of motorcycles, measured in terms of hybrid cars

A. remains constant. B. decreases. C. initially increases, then decreases. D. increases.