Which of the following would be most likely to push stock prices higher?

a. higher interest rates and the expectation of larger future corporate profits

b. higher interest rates and the expectation of smaller future corporate profits

c. lower interest rates and the expectation of larger future corporate profits

d. lower interest rates and the expectation of smaller future corporate profits

C

You might also like to view...

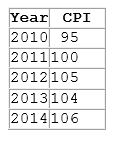

According to the table shown, what happened to the cost of living from 2013 to 2014? The cost of living:

A. increased; consumers became worse off than they would have been if the price level had not changed.

B. decreased; consumers became worse off than they would have been if the price level had not changed.

C. increased; consumers became better off than they would have been if the price level had not changed.

D. decreased; consumers became better off than they would have been if the price level had not changed.

The taxation principle that says people with higher incomes should pay more in taxes than those with lower incomes is called

A. A flat tax system. B. A regressive tax system. C. Horizontal equity. D. Vertical equity.

(Appendix) Suppose the production function for widgets is Q = (KL)½. If capital is fixed at 4 units, what is the marginal product of labor when you produce 10 units of output?

A. 0.4 B. 1.5 C. 1 D. 0.2

Those who contend that oligopolists are less likely than more competitive firms to engage in R&D say that:

A. oligopolists have little incentive to introduce costly new technology and produce new products when they currently are earning large economic profit using existing technology and selling existing products. B. the undistributed profits of oligopolists give them a source of readily available, relatively low-cost funds for financing R&D. C. entry barriers enable oligopolists to sustain the profits they gain from innovation. D. the large size of oligopolists' R&D departments allows them to use very specialized, expensive R&D equipment and employ teams of specialized researchers.