What is meant by revenue-neutral tax reform? How might agreeing to revenue-neutral tax reform help lead to a more efficient tax system?

What will be an ideal response?

Revenue-neutral tax reform means changing the tax system in some ways but keeping the amount of tax revenue collected constant. Agreeing to revenue neutrality when attempting to change the tax structure might help lead to a more efficient tax system by allowing legislators to focus on efficiency concerns without being sidetracked into debates over the overall level of taxation.

You might also like to view...

In 1935, John Hicks wrote, “The best of all monopoly profits is a quiet life.” What did he mean?

a. That monopolies are the best form of business enterprise b. That monopolies do not hire unionized workers c. That monopolies have no incentive to work at pleasing their customers d. That a quiet life is more important than high profits

When British soldiers in German prisoner of war camps during World War I smoked the best cigarettes and used the low-quality ones as money, they were obeying

a. Gresham's law that says bad money drives out good money b. Gresham's law that says good money drives out bad money c. the classical law that says bad money drives out good money d. the classical law that says velocity affects money e. Weldon's law that says velocity affects money

Which of the following statements is correct?

a. Purchasing Power Parity occurs when nominal interest rates are the same in two countries. b. Purchasing Power Parity means that the nominal exchange rate is 1 to 1. c. Purchasing Power Parity means that two countries have the same standard of living. d. Purchasing Power Parity means that the real exchange rate equals 1 to 1.

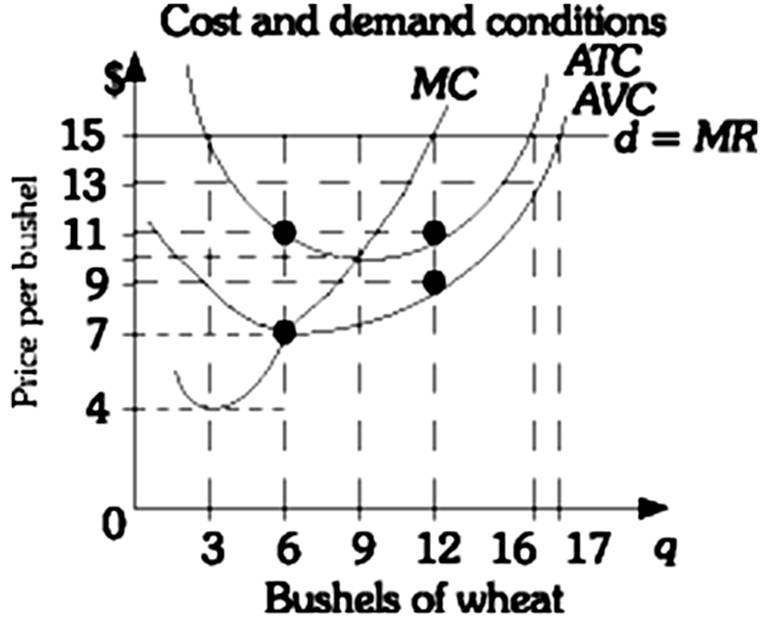

The profit maximizing level of output for this farmer is

A. 6.

B. 9.

C. 12.

D. 3.