If the government imposes a tax of $3,000 on everyone, the tax would be a(n)

a. income tax.

b. consumption tax.

c. lump-sum tax.

d. marginal tax.

c

You might also like to view...

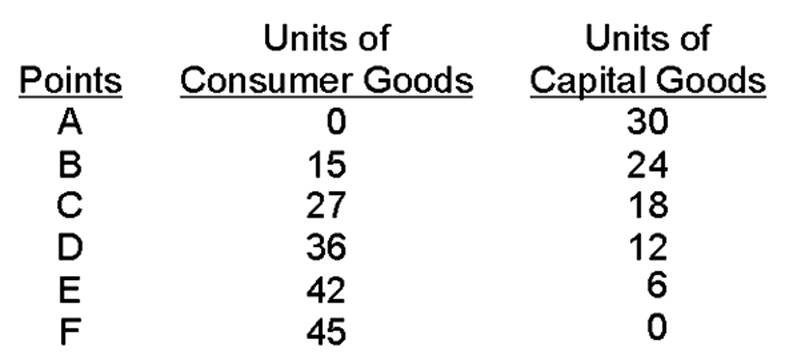

If the economy is producing at point D, the opportunity cost of shifting resources from consumer goods to gain 6 capital goods is _______ consumer goods.

The population theory of Thomas Malthus

(a) would have predicted the changes in per output in this country in the 19th century and up to 1910. (b) would lead you to expect a powerful surge in physical output as the immigration poured in. (c) would not have predicted the positive trend increase in per capita output and income in 1860–1910. (d) does not apply to any of the above.

In 2009, the U.S. budget deficit was $1.4 trillion

a. True b. False Indicate whether the statement is true or false

When interest rates fall in a given economy, it causes firms to borrow __________ funds used for purchasing capital goods. The result will be a(n) ___________ in the level of capital employed in the economy. In terms of the production function (graphed with labor on the horizontal axis and Real GDP on the vertical axis), this then causes ____________________ which makes the LRAS curve shift

____________ resulting in ______________________. A) more; increase; the production function to shift upward; rightward; economic growth B) less; decrease; the production function to shift downward; leftward; a shrinking economy C) more; increase; a movement up along a given production function; rightward; economic growth D) more; increase; a movement down along a given production function; leftward; a shrinking economy