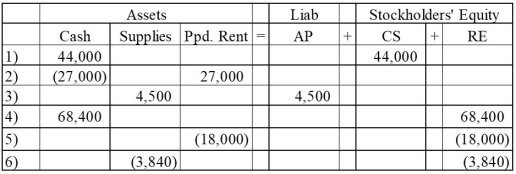

The following events apply to Bowman's Cleaning Service for Year 1.1) Issued stock for $44,000 cash.2) On May 1, paid $27,000 for one year's rent in advance.3) Purchased on account $4,500 of supplies to be used in the business.4) Performed services of $68,400 and received cash.5) At December 31, adjusted the records for the expired rent.6) At December 31, an inventory of supplies showed that $660 of supplies were still unused.Required: Draw an accounting equation and record the effects of the above events under the appropriate account headings. Show the year-end total for each account. Precede the amount with a minus sign if the transaction reduces that section of the equation. Enter 0 for items not affected.

What will be an ideal response?

You might also like to view...

A projective technique in which the respondent is required to construct a response in the form of a story, dialogue, or description is called the ________

A) association technique B) completion technique C) construction technique D) expressive technique E) evaluation technique

12) Comparing actual results to expected results is part of the ________.

A) controlling function of managerial accounting B) planning function of managerial accounting C) reporting function of managerial accounting D) organizing function of managerial accounting

A taxpayer is selling land held for investment purposes. Payments will be received under the terms of a five-year installment note. Which of the following circumstances would suggest consideration of an election out of the installment method?

A) A taxpayer currently works full-time but next year will start a two-year leave from work while pursuing an MBA degree. B) A taxpayer has a substantial capital loss carryforward. C) A taxpayer plans to reduce her employment to part-time next year when she has her first child. She believes she will continue part-time until the child starts kindergarten. D) Installment sale treatment is mandatory.

Revenues received during an accounting period increase owner's equity.

Answer the following statement true (T) or false (F)