Suppose that a tax is placed on a particular good. If the buyers end up bearing most of the tax burden, this indicates that the

a. demand is more inelastic than the supply.

b. supply is more inelastic than the demand.

c. government has required that buyers remit the tax payments.

d. government has required that buyers remit the tax payments.

A

You might also like to view...

Under the Soviet system of communism,

A) technological progress was slow because managers had little incentive to develop new technologies. B) managerial pay was determined by the extent to which managers could lower the per-unit costs of production. C) the per-worker production function in the Soviet Union shifted up more rapidly than production functions in other countries. D) competitive pressures in the Soviet Union allowed the country's technological progress to keep pace with the rest of the world.

Why isn't slope as useful as elasticity to measure the responsiveness of one variable to another?

What will be an ideal response?

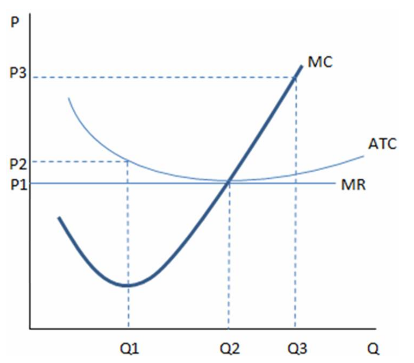

According the graph shown, the firm's most efficient scale of operation is to produce quantity:

This graph represents the cost and revenue curves of a firm in a perfectly competitive market.

A. Q1.

B. Q2.

C. Q3.

D. Any quantity as long as P1 is charged.

There are at least ______ factors in addition to price that affect demand.

a. three b. four c. five d. two