A firm can invest in one of two projects-the purchase of new delivery vans or the training of its sales staff in the use of new sales techniques. Both projects cost the same amount of money. The purchase of new delivery vans is expected to reduce costs by $5,000 each year for 10 years. The training of the sales staff in the use of a new sales technique is expected to increase revenues by $5,000 each year for 5 years. Which of the following is true?

A. The training of the sales staff would have the higher expected rate of return, as it increases revenues whereas the purchase of delivery vans only reduces costs.

B. Each of these projects would have the same expected rate of return, as they both cost the same.

C. The expected rates of return for these two projects cannot be compared, as one project reduces costs and the other increases revenues.

D. The purchase of delivery vans would have the higher expected rate of return, as it will reduce costs for a longer time period than the sales staff training will increase revenues.

Answer: D

You might also like to view...

Mary receives a consumer surplus of $500 from purchasing a purse. If the market price of the purse is $1,500, the price Mary is willing to pay is $1,600

a. True b. False Indicate whether the statement is true or false

Using game theory as an analytical tool, if one large nation imposes tariffs, the total cost is small; however, when several trading partners do the same:

a. the costs are even smaller. b. the costs balance out and there is no harm. c. the costs are the same but the potential gains are much smaller . d. then all nations gain.

The shorter the time until a payment the:

A. higher must be the interest rate. B. higher the present value. C. lower the present value because time is valuable. D. lower must be the interest rate.

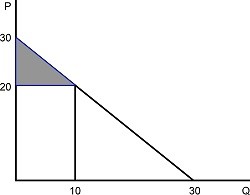

Figure 6.1If the good in Figure 6.1 were free:

Figure 6.1If the good in Figure 6.1 were free:

A. consumer surplus would equal $450 and consumer expenditure would be $0. B. consumer surplus and consumer expenditure would both be maximized. C. consumer surplus and consumer expenditure would both be zero. D. consumer surplus would be maximized but consumer expenditure would be impossible to calculate.