If you were to receive $100,000 from a corporation, the most tax-efficient way to receive it would be as

A) dividends.

B) interest.

C) capital gains.

D) salary.

Answer: C

You might also like to view...

An offer does not necessary need to be communicated to the offeree

Indicate whether the statement is true or false

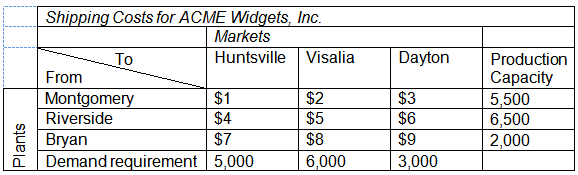

Refer to the data given in the table for Acme Widgets, Inc. Solve the transportation problem using Excel Solver. (Remember that in balanced transportation problems all constraints—except the non-negativity constraints of the decision variables—should be set as an equal to (=) sign in the Excel Solver dialogue.) At the optimum solution, the shipment from Montgomery to Huntsville is ______.

a. 0

b. 3,500

c. 4,500

d. 5,500

Liability for lost, delayed or damaged baggage is determined by

a. the Federal Trade Commission. b. the Federal Aviation Administration. c. each airline. d. Congress.

A trust designed for the benefit of a segment of the public or of the public in general is a(n) _________

Fill in the blank(s) with correct word