What is the endowment effect?

A) the tendency of people to be unwilling to sell something they already own even if they are offered a price that is greater than what they would be willing to pay to buy the good if they did not already own it

B) the tendency of people to be unwilling to sell something they already own because of its sentimental value

C) the tendency of people to overstate the value of a good they already own even though similar items can be purchased at a lower price

D) the sum total of assets that a person has acquired over the years

Answer: A

You might also like to view...

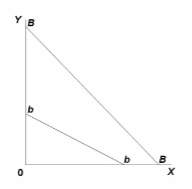

Figure 10-7

?

A. $1 per unit. B. $3 per unit. C. $5 per unit. D. $10 per unit.

Assume that the expectation of a recession next year causes business investments and household consumption to fall, as well as the financing to support it. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the quantity of real loanable funds per time period and net nonreserve international borrowing/investing in the context of the

Three-Sector-Model? a. The quantity of real loanable funds per time period falls and net nonreserve international borrowing/investing becomes more negative (or less positive). b. The quantity of real loanable funds per time period rises and net nonreserve international borrowing/investing becomes more negative (or less positive). c. The quantity of real loanable funds per time period falls and net nonreserve international borrowing/investing becomes more positive (or less negative). d. The quantity of real loanable funds per time period and net nonreserve international borrowing/investing remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.

The two parts that make up an option's price are:

A. the commission and the time value of the option. B. extrinsic value and the time value of the option. C. the price of the underlying asset and the time value of the option. D. the intrinsic value and the time value of the option.

The movement of the budget line from BB to bb in the figure suggests that income has:

A. increased and the price of X has decreased.

B. fallen and the price of Y has increased.

C. fallen and the price of Y has decreased.

D. decreased, but there have been no price changes.