The default-risk premium:

A. must always be greater than 0 (zero).

B. is also known as the risk spread.

C. is assigned by a bond-rating agency.

D. is negative for a U.S. Treasury bond.

Answer: B

You might also like to view...

Imagine that the state legislature raises the tax on gasoline by 10 cents/gallon. What most likely happens next?

A. Service station operators pass along the tax to you, adding the 10 cents to the price of a gallon of gas. B. Service station operators grumble, but pay the tax without passing the cost along to you. C. Service station operators pass along as much of the tax to you as they can, perhaps around 6 cents/gallon. D. The tax does not affect the outcome in the gasoline market.

If you included both time and entity fixed effects in the regression model which includes a constant, then

A) one of the explanatory variables needs to be excluded to avoid perfect multicollinearity. B) you can use the "before and after" specification even for T > 2. C) you must exclude one of the entity binary variables and one of the time binary variables for the OLS estimator to exist. D) the OLS estimator no longer exists.

A basic feature of the classical system of self-regulating markets was that

A. overproduction and unemployment would cause prices and wage rates to increase. B. flexible wages and prices would eliminate unemployment and overproduction. C. overproduction would never occur. D. an increase in saving would cause an increase in the interest rate and a decrease in investment spending.

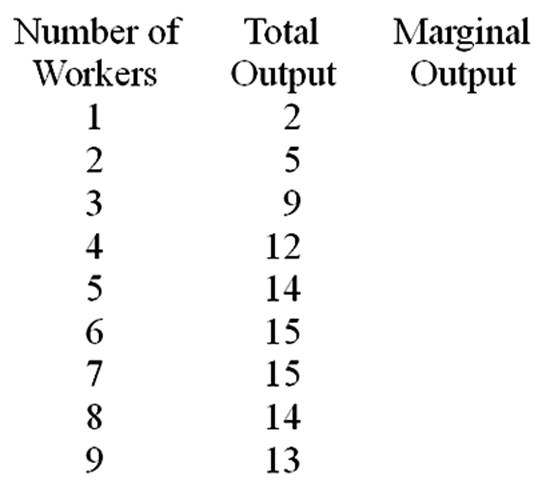

Fill in the Marginal Output column.