Suppose the industry producing good x is perfectly competitive, and good x can be produced only in integer quantities; i.e. you can't produce fractions of units. Each firm only uses labor as an input, and the marginal product of labor is diminishing throughout.a.

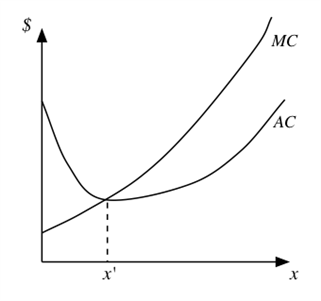

a. Draw marginal and average cost curves for a firm in this industry.

b. In a perfectly competitive equilibrium in which X* unit are sold at price p*, how many firms are operating?

c. Now suppose there is a recurring fixed cost FC. How does that change your picture from part (a)?

d. How does firm output, industry output, equilibrium price and the number of firms in the industry change as FC increases assuming the market continues to be perfectly competitive?

e. In what sense might it become unreasonable to assume competitive (i.e. price-taking) behavior as FC gets large? If firms were to "think strategically" and price is the strategic variable, what happens to profit as FC increases?

f. How would your answers to (d) and (e) change if firms produced different varieties of x?

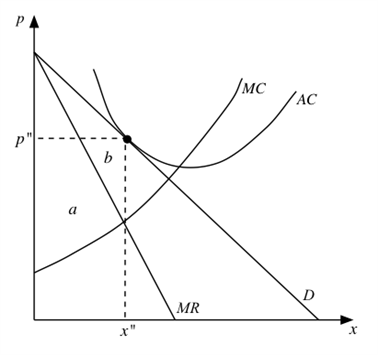

g. What is the highest possible FC that would result in x still being produced (assuming no firm can ever price-discriminate)? Assume market demand is linear and illustrate the firm's cost curves, output quantity and price.

What will be an ideal response?

b. Each firm would produce at the lowest point of its average cost curve - which occurs at output quantity 1. Thus there would be X* firms in the market, each producing exactly 1 unit of output.

c. The marginal cost curve would not change, but the average cost curve would now be U-shaped.

d. Firm output now increases from 1 (in (b)) to x' in (c). The equilibrium price also increases as the lowest point of AC rises. At a higher price, less ill be demanded in the market - and with each firm producing more, this implies there will be fewer firms.

e. As FC gets large, the number of firms falls - eventually leading to an economic environment where each firm is no longer "small" relative to the market. At that point, firms become strategic players. But if price is the strategic variable, then Bertrand price competition will result in zero profit for firms.

f. Product differentiation will allow Bertrand price competitors to charge prices that lead to positive profit.

g. In the graph, this implies that FC = a + b; This also implies p''=AC -- and so the AC curve is tangent to demand at p''.

You might also like to view...

In the above figure, the perfectly competitive firm's shutdown point is at a price of

A) $4 per unit. B) $8 per unit. C) $12 per unit. D) $16 per unit.

What makes the macroeconomic performance of the 1993 to 1998 period so unusual is the

A. simultaneous occurrence of unemployment and inflation increases. B. simultaneous occurrence of real GDP decreases and inflation rate increases. C. occurrence of real GDP decreases while the unemployment rate increases. D. simultaneous occurrence of reduced unemployment rates and falling inflation rates.

When demand curves shift to the left, buyers become less sensitive to price increases because they consume fewer of these goods

Indicate whether the statement is true or false

Vault cash is not included in the central bank's liability category of currency because:

A. vault cash is in the asset category of reserves. B. vault cash really is only electronic funds. C. only non-bank currency is in the liability category of currency. D. it is the liability of the U.S. Treasury.