The partnership's net income for the first year is $50,000. Nancy's capital balance is $83,000 and Betty's capital balance is $11,000 at the end of the year. Calculate the share of profit/loss to be allocated to Betty.

Nancy and Betty enter into a partnership agreement where they decide to share profits according to

the following rules:

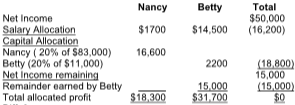

(a) Nancy and Betty will receive salaries of $1700 and $14,500 respectively as the first allocation.

(b) The next allocation is based on 20% of each partner's capital balances.

(c) Any remaining profit or loss is to be allocated completely to Betty.

A) $18,300

B) $31,700

C) $3760

D) $16,100

B) $31,700

Explanation: The allocation of profit or loss can also be based on a combination of services, capital

balances, and stated ratios. A partnership might want to use this method if one partner contributes more

capital but the other partner devotes more time to the business.

Calculation:

You might also like to view...

Which of the following does not describe unstructured data?

A. No specified format. B. Emails, twitter tweets, and text messages. C. A defined length, type, and format. D. Free-form text.

The United States has the lowest wage gap among all developed countries.

Answer the following statement true (T) or false (F)

Doubling the size of the sample will

a. reduce the standard error of the mean to one-half its current value. b. reduce the standard error of the mean to approximately 70% of its current value. c. have no effect on the standard error of the mean. d. double the standard error of the mean.

A one-tailed test is a hypothesis test in which rejection region is _____

a. in both tails of the sampling distribution b. in one tail of the sampling distribution c. only in the lower tail of the sampling distribution d. only in the upper tail of the sampling distribution