A recent innovation by Amazon, the Vendor Flex program, seeks to lower overall transportation costs but also creates new forms of channel conflict with competitors. As a partner in the Vendor Flex program, P&G agreed to allow Amazon to build fulfillment centers within P&G's own warehouses, thus helping to eliminate some of the costs of transporting P&G's products to Amazon's fulfillment centers. Believing that the program was giving its competitor Amazon an unfair advantage, Target reacted vigorously, moving all P&G products from prominent end-cap positions in its stores to less prestigious and less visible locations. Target also stopped using P&G as its primary source of advice for planning merchandising strategies within each category. This is an example of ________ channel conflict.

A. coercive

B. conventional

C. independent

D. horizontal

E. vertical

Answer: D

You might also like to view...

The Calvin-Dogwood Partnership owns inventory that was purchased for $90,000, has a current replacement cost of $85,900, and is priced to sell for $125,000 . At what amount should the inventory be recorded in the accounts of the new partnership if Alexis is to be admitted?

a. $129,100 b. $85,900 c. $90,000 d. $125,000

Which of the following statements does not describe the benefits of utilizing distribution centers over direct store delivery?

A. The effects of forecast error for the individual stores are minimized and less backup inventory is needed to prevent stockouts. B. The use of distribution centers increases inventory investment. C. It is easier to avoid running out of stock or having too much stock in any particular store because merchandise is ordered from the distribution center as needed. D. More accurate sales forecasts are possible when retailers combine forecasts for many stores serviced by one distribution center rather than doing a forecast for each store. E. Distribution centers enable the retailer to carry less merchandise in the individual stores.

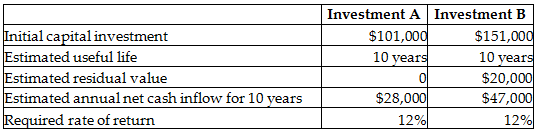

Calculate the payback period for Investment A. (Round your answer to two decimal places.)

Dragonfly, Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available:

A) 2.22 years

B) 2.89 years

C) 1.00 year

D) 3.61 years

__________is the largest Latin American trade agreement and includes Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, and Venezuela

Fill in the blanks with correct word.