A company had beginning inventory of 12 units at a cost of $12 each on March 1. On March 2, it purchased 12 units at $18 each. On March 6 it purchased 7 units at $17 each. On March 8, it sold 28 units for $60 each. Using the perpetual FIFO inventory method, what was the cost of the 28 units sold?

A. $372

B. $476

C. $428

D. $479

E. $360

Answer: C

You might also like to view...

Which of the following is NOT an option for the IRS tax compliance auditor when it is determined that taxes were underpaid?

a. Civil fines can be assessed. b. Penalties can be levied. c. The case can be referred to the IRS's Criminal Investigation Division. d. Charges can be pressed in the courts.

On September 1 of the current year, Scots Company experienced a flood that destroyed the company's entire inventory. Because the company had not completed its month end reporting for August, it must estimate the amount of inventory lost using the gross profit method. At the beginning of August, the company reported beginning inventory of $215,800. Inventory purchased during August was $192,670. Sales for the month of August were $543,200. Assuming the company's typical gross profit ratio is 40%, estimate the amount of inventory destroyed in the flood.

A. $134,730 B. $81,550 C. $191,190 D. $87,550 E. $82,550

The practice of accepting a selling price when there is excess capacity, as long as it exceeds variable cost is called:

a. Contribution pricing. b. Differential pricing. c. Capacity pricing. d. Special pricing.

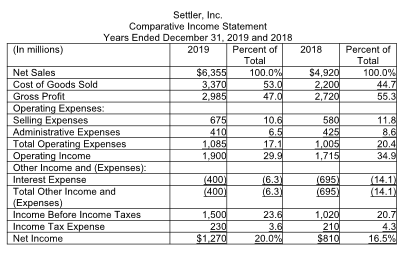

The 20% shown for net income in 2019 signifies that net income ________.

The vertical analysis of the income statement of Settler, Inc. is as shown below:

A) is 20% of net sales revenues

B) increased by 20% over the previous year

C) is 20% of gross profit

D) equals 20 times of the income before income tax