If a corporation goes bankrupt:

A. neither stockholders nor bondholders receive any money.

B. stockholders get paid from the sale of company assets before bondholders do.

C. bondholders get paid from the sale of company assets before stockholders do.

D. stockholders must honor the debts to bondholders out of personal assets if necessary.

C. bondholders get paid from the sale of company assets before stockholders do

You might also like to view...

How do changes in income tax policies affect aggregate demand?

A) Higher taxes increase corporate investment and aggregate demand. B) Higher taxes reduce disposable income, consumption, and aggregate demand. C) Higher taxes increase aggregate supply and thus increase aggregate demand as well. D) Higher taxes increase disposable income, consumption, and aggregate demand.

In most cases, the higher is the quality of the collateral for a loan is

A) the higher is the interest rate. B) the lower is the interest rate. C) the riskier is the loan. D) the greater is the handling charge for the loan.

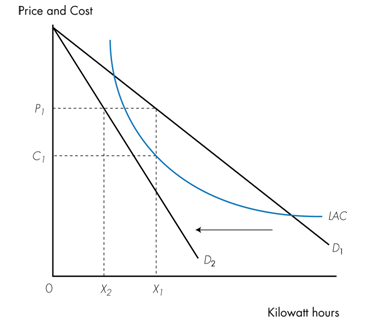

Refer to the graph below for a natural monopoly. Assume the demand for the natural monopoly is originally D1. Now suppose a second firm enters the market and the demand for each firm becomes D2. The result will be

a. profit to rise for both firms.

b. profit to fall for the original natural monopoly firm and a profit to be earned by the new second firm.

c. profits to continue to be enjoyed by the original natural monopoly but a loss for the new second firm.

d. losses for both firms.

If net exports are positive, then

a. exports are greater than imports. b. net capital outflow is negative. c. Both of the above are correct. d. Neither of the above is correct.