Government can overcome the free rider problem by taxing individuals and then using the tax proceeds to provide the nonexcludable public good itself.

Answer the following statement true (T) or false (F)

True

You might also like to view...

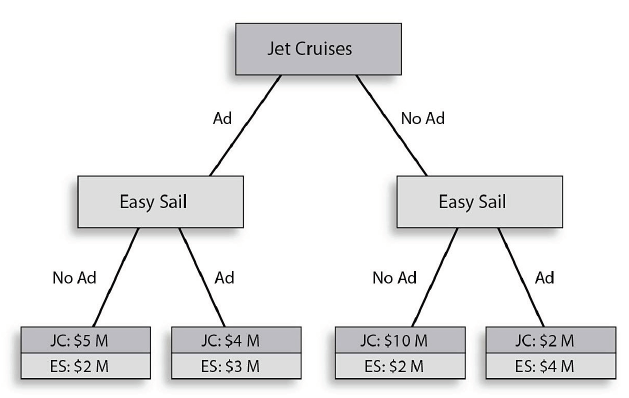

If Jet Cruises chooses to No Ad and Easy Sail then chooses to No Ad, Jet Cruises earns ________ million in net profit and Easy Sail earns ________ million.

Jet Cruises wants to prevent Easy Sail from entering the sailboat market. The above game tree illustrates the different strategies and corresponding payoffs for the two firms. Both Jet Cruises and Easy Sail have the same strategies of advertising (Ad) or not advertising (No Ad). The payoffs represent net profit in millions.

A) $5; $2 B) $2; $4 C) $4; $3 D) $10; $2

A negative externality or spillover cost (additional social cost) occurs when

A. the price of the good exceeds the marginal cost of producing it. B. the total cost of producing a good exceeds the costs borne by the producer. C. firms fail to achieve allocative efficiency. D. firms fail to achieve productive efficiency.

If an accountant makes $80,000 and after deductions pays $8,000 in taxes while an administrative assistant makes $35,000 and after deductions pays $2,000 in taxes, this is an example of

A. Vertical equity. B. Effective inequity. C. Marginal inequity. D. Horizontal equity.

Carlos can produce the following combinations of X and Y: 10X and 10Y, 5X and 15Y, and 0X and 20Y. The opportunity cost of one unit of X for Carlos is

A) 1 unit of Y. B) 2 units of Y. C) 1/2 unit of Y. D) 1/4 unit of Y. E) none of the above