During June 2019, Andy Company had the following transactions:

1. Sales of $185,000 ($142,000 on account, $43,000 for cash).

2. Collections on account, $128,000

3. Write-offs of uncollectible receivables, $1,900

4. Recovery of receivable previously written off, $600.

Additional information:

Ignore Cost of Goods Sold

Andy uses the allowance method for uncollectibles.

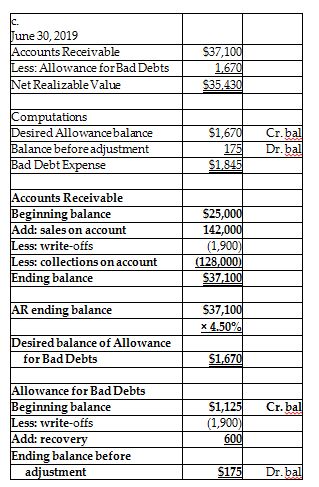

Andy estimates that 4.50% of its accounts receivable will be uncollectible.

On June 1, 2019, the Accounts Receivable balance was $25,000 and the Allowance for

Bad Debts had a normal account balance of $1,125.

Requirements:

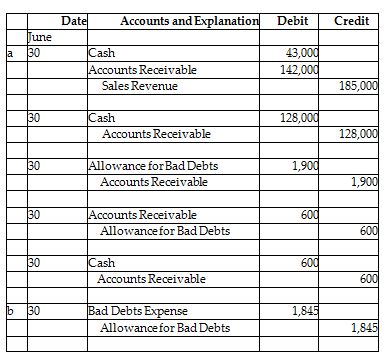

a. Prepare the journal entries for the June 2019 transactions. Because the transactions represent a summary of events, use June 30 for all dates. Omit explanations.

b. Prepare the June 30, 2019 adjusting journal entry. Omit explanation.

c. What is the net realizable value of Accounts Receivable on June 30, 2019 (after the adjusting journal entry has been posted)? Show computations and label your work.

You might also like to view...

Placing information about job vacancies and qualifications in places where employees can see them such as on bulletin boards or the company's intranet is called

A. job analysis. B. realistic job previewing. C. position advertising. D. recruiting. E. job posting.

When American Airlines acquired U.S. Airways, this was an example of a contractual VMS.

Answer the following statement true (T) or false (F)

Luke and Maya form Northeast Air Express, a general partnership. The essential elements of this partnership do not include? A) a sharing of profits and losses

B) a joint ownership of the business. C) an equal right to management in the business. D) goodwill.

Which of the following is not a factor in determining a CEO’s compensation?

a. Company size b. Competition within the industry c. Internationalization d. Company performance