An analysis of the incidence of a unit tax on suppliers versus a unit tax on demanders shows us that the _____ of a tax may be different from the _____ of a tax

a. actual burden; distribution

b. payment; distribution

c. amount; incidence

d. actual burden; legal assignment

d

You might also like to view...

Firms are not likely to include their sunk costs when calculating their true cost of supplying goods if they

A) are calculating their income for tax purposes. B) have been accused by competitors of "dumping." C) have been accused by customers of "price gouging." D) must request price increases from a regulatory commission. E) want subsidies from the government.

Refer to Table 2-1. Assume Dina's Diner only produces sliders and hot wings. A combination of 40 sliders and 25 hot wings would appear

A) along Dina's production possibilities frontier. B) inside Dina's production possibilities frontier. C) outside Dina's production possibilities frontier. D) at the vertical intercept of Dina's production possibilities frontier.

Assume that in the economy real GDP grows at a constant rate. There has just been a decrease in the rate of growth of the population. This implies that the

A) rate of growth of per capita real GDP will decrease. B) rate of growth of per capita real GDP will increase. C) rate of growth of capital accumulation will decrease. D) rate of growth of capital accumulation will increase.

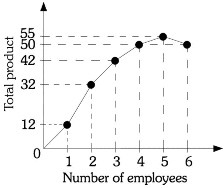

Refer to the information provided in Figure 7.4 below to answer the question(s) that follow.  Figure 7.4Refer to Figure 7.4. The average product with six workers is

Figure 7.4Refer to Figure 7.4. The average product with six workers is

A. -8.33. B. -5. C. 5. D. 8.33.