Suppose that a firm has to pay a 10% tax on its total revenue. This has the effect of

a. flattening marginal cost.

b. increasing marginal revenue.

c. decreasing marginal cost.

d. decreasing marginal revenue.

d

You might also like to view...

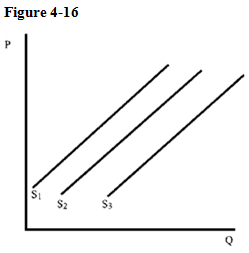

A. S1to S2. B. S2to S1. C. S2to S3. D. S1to S3.

Refer to Table 19-19. Given the information above, calculate the GDP deflator in 2015

A) 87 B) 95 C) 105 D) 114

In a _____ the outsider buys the shares with debt collateralized by its other assets, and sometimes also by the target's assets

a. merger b. cash tender c. proxy fight d. leveraged buyout

The fiscal policy action most likely to increase consumer spending would be _____.

a. increasing the individual income tax rate b. decreasing the individual income tax rate c. increasing the business tax rate d. decreasing the business tax rate