The reserve ratio is 10 percent and all loan proceeds are deposited in transactions accounts. A bond dealer has $100 million in deposits, $8 million in vault cash, and $7 million in deposits at the Fed

The Fed sells $1 million in securities to the bond dealer. As a result, of this transaction alone

A) the money supply falls by $1 million and total reserves rise by $1 million.

B) the money supply falls by $1 million and total reserves fall by $1 million.

C) the money supply rises by $1 million, total reserves fall by $900,000.

D) the money supply rises by $1 million, but reserves do not change.

B

You might also like to view...

Inflation can be defined as

A) an increase in the purchasing power of money. B) a decrease in the purchasing power of money. C) no change in the purchasing power of money. D) an increase in real income.

A market economy is an economy where:

a. economic decisions are passed down from government authority and resources are owned by the government. b. economic decisions are economic decisions are centralized, resources are owned by private individuals, and businesses supply goods and services based on demand. c. economic decisions are decentralized, resources are owned by private individuals, and businesses supply goods and services based on demand. d. economic decisions are passed down from government authority and resources are owned by individuals.

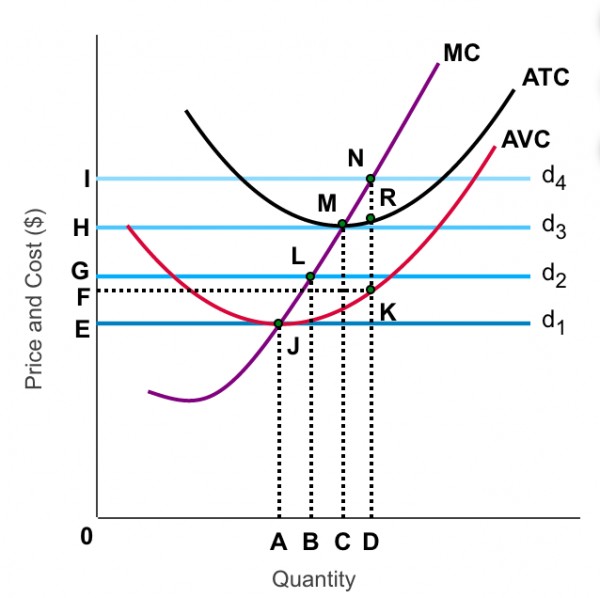

In the figure at? right, assume this firm is operating on d3. Which is? true?

A. This firm is breaking even

B. This firm is earning an economic profit

C. This firm's total revenue equal HRD0

D. This firm is experiencing an economic loss

The cross price elasticity for Bud Light for a change in the price of Coor's Light is likely to be

A. negative but less negative than -1. B. positive. C. negative and more negative than -1. D. zero.