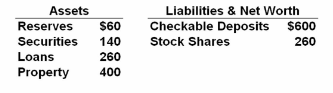

Refer to the given data. Suppose the Fed wants to increase the money supply by $400 billion to drive down interest rates and stimulate the economy. Assuming that the money multiplier is operating to full effect, to accomplish the desired increase, the Fed could:

Answer the question on the basis of the following consolidated balance sheet of the

commercial banking system. Assume that the reserve requirement is 10 percent. All figures

are in billions and each question should be answered independently of changes specified in

any preceding ones.

A. sell $20 billion of U.S. securities to the banks.

B. buy $20 billion of U.S. securities from the banks.

C. sell $40 billion of U.S. securities to the banks.

D. buy $40 billion of U.S. securities from the banks.

D. buy $40 billion of U.S. securities from the banks.

You might also like to view...

Students who talk loudly with each other in class

A) create an externality because other students cannot follow the lecture as well. B) disturb nobody. C) benefit the other students in class because they engage in conversation. D) only create an externality if they talk about something unrelated to class.

A decrease in real GDP would affect the U.S. economy by:

a. cutting tax revenues and raising government expenditures. b. cutting government expenditures and raising tax revenues. c. raising both tax revenues and government expenditures. d. cutting both government expenditures and tax revenues.

What type of relationship does the real interest rate have with respect to Investment spending?

A. negative relationship B. positive relationship C. No relationship D. constant relationship

The official dividing line between the poor and nonpoor is called the

a. life threshold. b. life edge. c. poverty line. d. beginning line.