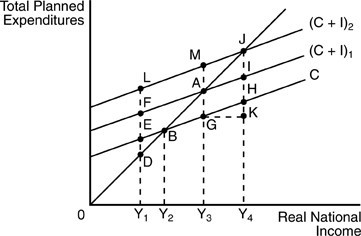

In the above figure, at an income level of Y3 and planned expenditures of (C + I)1

In the above figure, at an income level of Y3 and planned expenditures of (C + I)1

A. the economy is in equilibrium.

B. planned saving exceeds planned investment.

C. the quantity of aggregate demand exceeds real Gross Domestic Product (GDP).

D. there is full employment.

Answer: A

You might also like to view...

When a Pigouvian tax is imposed, ________

A) the marginal private cost curve shifts upward B) the demand curve shifts rightward C) the marginal social cost curve shifts downward D) the marginal social benefit curve shifts downward

Assume Jean-Claude purchased real estate for $500,000 using $50,000 of which is his own money and $450,000 of which he borrowed at an 8 percent interest rate. If the value increased by 10 percent in one year and he sold the property, what was Joe’s rate of return on his investment? If the value of the property had declined by 2 percent, what would have been the rate of return on his investment?

What will be an ideal response?

The largest U.S. economic expansion between 1890 and the present occurred during which of the following events?

a. The Railroad Prosperity b. World War II c. The Great Tuna Boom d. The OPEC Prosperity of 1974

The "monetary policy transmission mechanism" connects

A. individual income tax rates to aggregate supply. B. open market purchases to the Fed's balance sheet. C. short-term interest rates to aggregate demand. D. individual income tax rates to aggregate demand.