Aimee sells hand-embroidered dog apparel over the Internet. Her annual revenue is $128,000 per year, the explicit costs of her business are $42,000, and the opportunity costs of her business are $30,000. What is her accounting profit?

A) $12,000 B) $56,000 C) $86,000 D) $98,000

C

You might also like to view...

Color television prices rise by 10 percent, and in response the quantity of those TVs supplied increases by 6 percent. The supply elasticity for color television sets in that price range is

A) 0.6. B) 1.66. C) 6.0. D) -1.66.

Most taxes distort incentives and move the allocation of resources away from the social optimum. Why do corrective taxes avoid the disadvantages of most other taxes?

a. Corrective taxes apply only to goods that are bad for people's health, such as cigarettes and alcohol. b. Because corrective taxes correct for market externalities, they take into consideration the well-being of bystanders. c. Corrective taxes provide incentives for the conservation of natural resources. d. Corrective taxes do not affect deadweight loss.

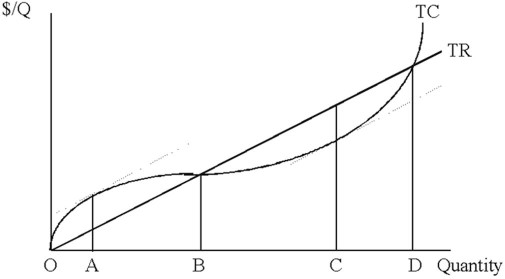

In the graph shown below, if the market demand were to shift right, which of the following would occur for the firm?

A. The total cost curve would shift downward. B. The total revenue function would rotate downward. C. The total revenue function would rotate upward. D. The firm would produce less output.

A market-determined price

A. is determined by the manager of a firm. B. is an endogenous variable C. is determined by the intersection of demand and supply curves. D. both a and b E. both b and c