Suppose an oligopoly has a dominant firm that sets the price for the entire industry. In this situation, the oligopoly has:

a. nonprice competition. b. a kinked demand curve.

c. price leadership. d. a cartel.

c

You might also like to view...

Which of the following best represents an indirect tax?

A) federal income tax B) state income tax C) local property tax D) sales taxes paid on goods and services

Which firm is not dealing with adverse selection

a. a manufacturer requires a 90 day probationary period for new employees b. a temporary clerical agency hires without verifying typing skills c. a manufacturer requires suppliers to be ISO 900 . certified d. Smokers get the worse life insurance rates as non-smokers

If a bank sells a $1,000 security to the Fed and the required reserve ratio is 20 percent: a. the bank has $1,000 in additional excess reserves, of which it can lend $800. b. the bank has $1,000 in additional excess reserves, all of which it can lend out. c. the bank has lost an asset and must reduce its loans

d. the bank has lost a liability. e. there is no change in excess reserves, since net assets do not change.

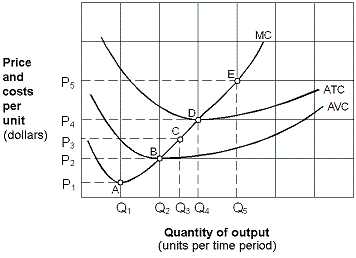

Exhibit 8-13 Price and cost per unit curves

A. A. B. B. C. C. D. D.