Suppose New York City passes a local "big gulp" tax that taxes carbonated beverages larger than 20 ounces if they contain sugar or high fructose corn syrup. If the revenue from the "big gulp" tax is earmarked for diabetes research, the "big gulp" tax may be justified

a. on the basis of the ability-to-pay principle.

b. because it is an example of a lump-sum tax and thus is the most efficient tax.

c. on the basis of the benefits principle.

d. because it is an example of a progressive tax and thus is the most equitable tax.

c

You might also like to view...

Paul runs a shop that sells printers. Paul is a perfect competitor and can sell each printer for a price of $300

The marginal cost of selling one printer a day is $200; the marginal cost of selling a second printer is $250; and the marginal cost of selling a third printer is $350. To maximize his profit, Paul should sell A) one printer a day. B) two printers a day. C) three printers a day. D) more than three printers a day.

You borrow $10,000 from a bank for one year at a nominal interest rate of 5%. If inflation over the year is 2%, what is the real interest rate you are paying?

A) 2% B) 2.5% C) 3% D) 5%

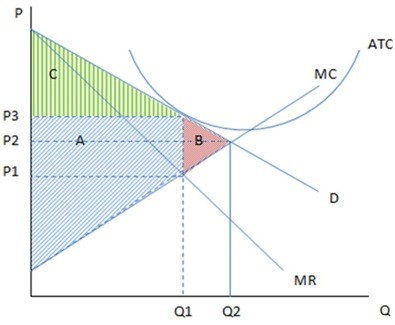

These are the cost and revenue curves associated with a firm. If the firm in the graph were producing Q2 and charging P2, it:

If the firm in the graph were producing Q2 and charging P2, it:

A. represents the perfectly competitive outcome. B. is an outcome that eliminates deadweight loss. C. is an efficient outcome. D. All of these statements are true.

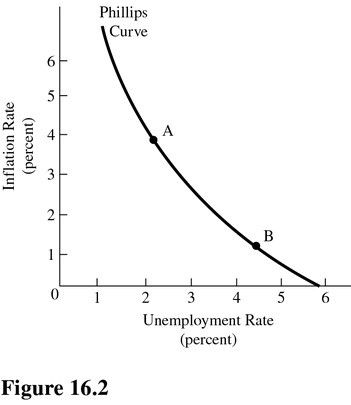

In Figure 16.2, according to supply-side theorists, an increase in mandatory employee benefits would result in a

In Figure 16.2, according to supply-side theorists, an increase in mandatory employee benefits would result in a

A. Rightward shift in the Phillips curve. B. Movement from point A to point B. C. Leftward shift in the Phillips curve. D. Movement from point B to point A.