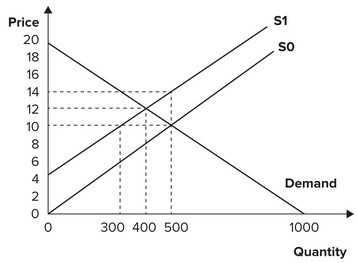

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $10 and a quantity of 500 units. If the government imposes a $4 per-unit tax on this product, the deadweight loss from the tax will be:

A. 1,600.

B. 400.

C. 1,800.

D. 200.

Answer: D

You might also like to view...

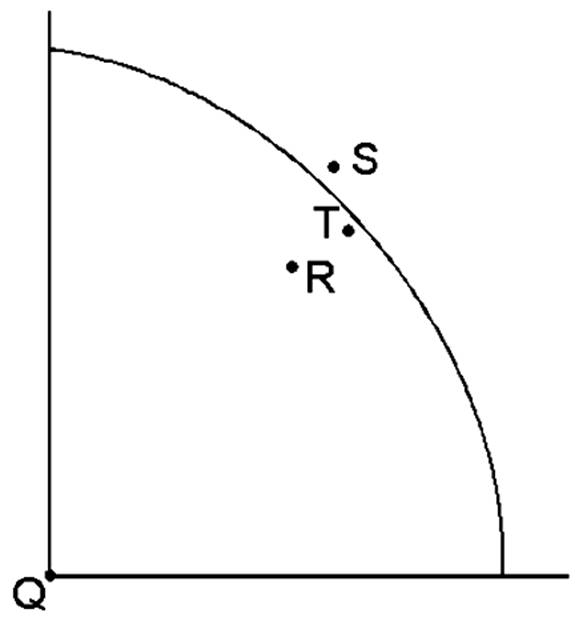

If the economy is at point R, most likely this economy is experiencing __________.

Aggregate expenditure is total:

A. spending on final goods and services. B. value added in the economy. C. revenue from the sale of goods and services. D. income of households, businesses, governments, and foreigners.

As a result of the rightward shift in the demand curve for labor from LD0 to LD1, the equilibrium level of employment ________ and potential GDP ________

A) increases; increases B) increases; decreases C) decreases; increases D) decreases; decreases

The two most comprehensive, widely accepted macroeconomic models are

A) the classical model and the supply-side model. B) the supply-side model and the real business cycle model. C) the classical model and the Keynesian model. D) the Austrian model and the Keynesian model.