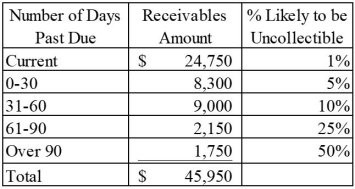

Chico Company began Year 2 with balances in accounts receivable and allowance for doubtful accounts of $44,300 and $1,675, respectively. The company reported credit sales of $490,250 during the year, and wrote off $1,400 of uncollectible accounts. Chico Company prepared the following aging schedule on December 31, Year 2: Required:a) Prepare these general journal entries: (1) Credit sales (2) Collection of accounts receivable (3) Write-off of uncollectible accounts (4) Adjusting entry for uncollectible accountsb) Determine the net realizable value of accounts receivable.

Required:a) Prepare these general journal entries: (1) Credit sales (2) Collection of accounts receivable (3) Write-off of uncollectible accounts (4) Adjusting entry for uncollectible accountsb) Determine the net realizable value of accounts receivable.

What will be an ideal response?

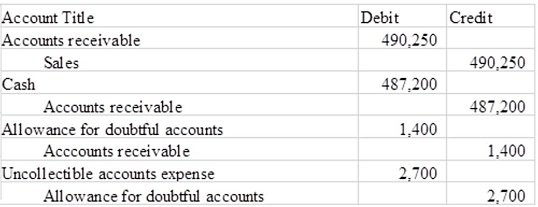

a)

b) $42,975

a) (2) Ending accounts receivable of $45,950 = Beginning accounts receivable of $44,300 + Credit sales of $490,250 ? Collections on account (the unknown) ? Write-offs of $1,400 Cash collections on account = $44,300 + $490,250 ? $1,400 ? $45,950 = $487,200

a) (4) Ending allowance for doubtful accounts balance = ($24,750 × 1%) + ($8,300 × 5%) + ($9,000 × 10%) + ($2,150 × 25%) + ($1,750 × 50%) = $2,975

Ending allowance for doubtful accounts of $2,975 = Beginning allowance for doubtful accounts of $1,675 + Uncollectible accounts expense (the unknown) ? Write-offs of $1,400

Uncollectible accounts expense = $2,975 ? $1,675 + $1,400 = $2,700

b) Net realizable value = Accounts receivable of $45,950 ? Allowance for doubtful accounts of $2,975 = $42,975

You might also like to view...

In a vertical analysis of the balance sheet, the 100% amount is

a. Current assets b. Working capital c. Total assets d. Total stockholders' equity

A vertical audit is often referred to as a "retailing mix" audit

Indicate whether the statement is true or false

Which of the following statements refers to liquidated damages?

A) They are damages in excess of compensatory damages that the court awards for the sole purpose of deterring the defendant and others from doing the same act again. B) They are damages awarded to the party that is injured by a breach of contract but cannot establish actual damages. C) They are damages for nonperformance that are stipulated in a clause in the contract. D) They are damages designed to place the non-breaching party in the position that party would have enjoyed had the terms of the contract been performed.

Which of the following mathematical expressions computes the net worth of a firm?

A. Net worth = Current assets minus current liabilities B. Net worth = Total assets minus current liabilities C. Net worth = Total liabilities minus current assets D. Net worth = Total assets minus total liabilities E. Net worth = Total liabilities minus current liabilities