Suppose in year 1 the CPI is 90, in year 2 the CPI is 100, and in year 3 the CPI is 110. Then, inflation is

A) 11 percent between years 2 and 3.

B) 11 percent between years 1 and 2.

C) 100 percent in year 1.

D) 10 percent between years 2 and 3.

E) Both answers B and D are correct.

B

You might also like to view...

Suppose that a bond-financed deficit shifts the IS curve to the right, taking IS-LM equilibrium "northeast" from point A to point B

If government bonds are considered net wealth by the public sector, then by the portfolio theory of asset-holding there is an excess ________ money at point B because the LM curve has shifted ________ with increased wealth, and thus the fiscal policy turns out to be ________ expansionary than without the wealth effect. A) demand for, downward, more B) demand for, downward, less C) demand for, upward, less D) supply of, downward, more E) supply of, upward, more

Suppose a firm has a weekly cost function of C(Q) = 8Q + (Q2/100) and a marginal cost function of MC = 8 + (Q/50). What is the efficient scale of production, and what is the minimum average cost?

A. Qe = 0; AC = $0 B. Qe = 0; AC = $8 C. Qe = 8; AC = $8 D. Qe = 8; AC = $64.64

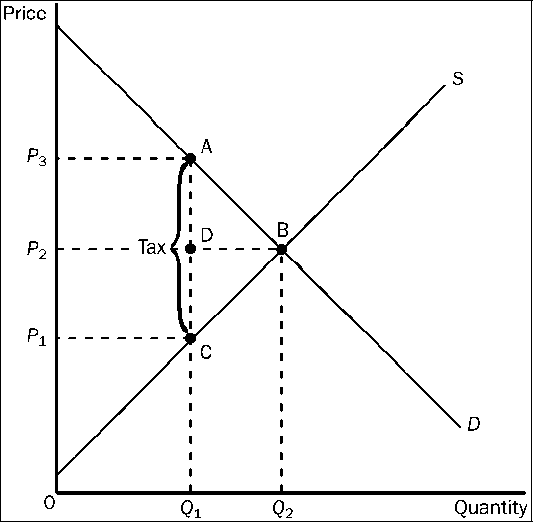

Figure 4-24

Refer to . The amount of tax revenue received by the government is equal to the area

a.

P3 A C P1.

b.

A B C.

c.

P2 D A P3.

d.

P1 C D P2.

If an economy is experiencing deflation, a decrease in the price level, then the most advantageous actions would be

A. borrowing money at a fixed interest rate and buying a house. B. borrowing money at a fixed interest rate and buying land. C. keeping money in a checking account. D. keeping your wealth in gold and other precious metals.