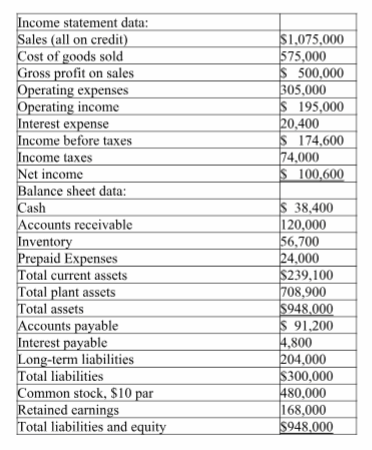

Use the following information from the current year financial statements of a company to calculate the ratios below:

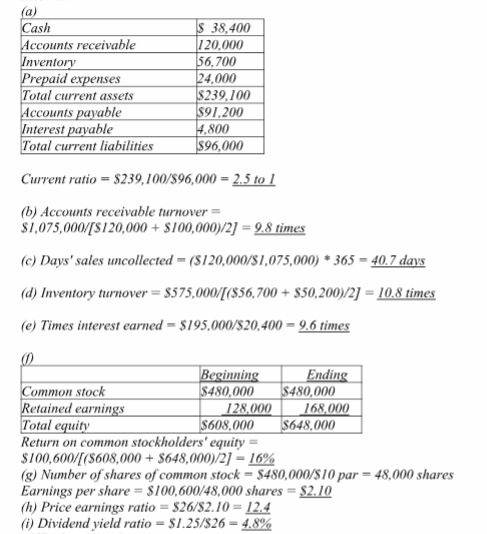

(a) Current ratio.

(b) Accounts receivable turnover. (Assume the prior year's accounts receivable balance was $100,000.)

(c) Days sales uncollected.

(d) Inventory turnover. (Assume the prior years inventory was $50,200.)

(e) Times interest earned ratio.

(f) Return on common stockholders equity. (Assume the prior year's common stock balance was $480,000 and the retained earnings balance was $128,000.)

(g) Earnings per share (assuming the corporation has a simple capital structure, with only common stock outstanding).

(h) Price earnings ratio. (Assume the company's stock is selling for $26 per share.)

(i) Divided yield ratio. (Assume that the company paid $1.25 per share in cash dividends.)

You might also like to view...

An understatement of reported net income for the current year may result from

A) an understatement of beginning inventory in the previous period. B) an overstatement of ending inventory in the current period. C) failure to record accrued payroll liabilities. D) failure to record accrued interest revenue.

You are the auditor of Browning, Inc, a manufacturer of plastic products. In reviewing the balance sheet of the company, you notice several receivables from the officers of the company. You report your findings to the president of the company and inform

him that these receivables will be considered related party transactions for purposes of financial accounting and reporting. The president seems somewhat annoyed by your comments and asks you to explain what you mean by "related party" transactions and how the financial statements will be affected by these transactions. Prepare a brief response to the president's question.

A company issued 70 shares of $30 par value preferred stock for $4,000 cash. The journal entry to record the issuance is:

A. Debit Preferred Stock $2,100, debit Investment in Preferred Stock $1,900; credit Cash $4,000. B. Debit Cash $2,100; credit Preferred Stock $2,100. C. Debit Cash $4,000; credit Paid-in Capital in Excess of Par Value, Preferred Stock $1,900, credit Preferred Stock $2,100. D. Debit Cash $4,000; credit Preferred Stock $4,000. E. Debit Investment in Preferred Stock $2,100; credit Cash $2,100.

A beneficiary of personal property by will may be called a devisee

Indicate whether the statement is true or false