If all variable taxes in the United States were removed and only fixed taxes remained, what would be the effect on the expenditures schedule?

a. The expenditure schedule will shift upward and become steeper.

b. The expenditure schedule will shift upward and become less steep.

c. The expenditure schedule will shift downward and become less steep.

d. The expenditure schedule will shift downward and become steeper.

a

You might also like to view...

How does slow price adjustment, as assumed in Keynesian models, result in real economic variables being affected by nominal variables?

What will be an ideal response?

In the United States, the average level of educational attainment is approximately a

A. primary education. B. secondary education. C. higher education. D. graduate-level education.

If the production of a particular good involves significant external costs, to force the externality to be internalized the government might:

a. impose a tax on production of the good in order to increase production. b. impose a tax on production of the good in order to decrease production. c. offer a subsidy for production of the good in order to increase production. d. offer a subsidy for production of the good in order to decrease production.

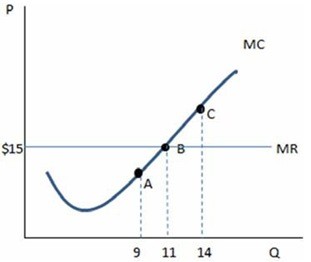

According to the graph shown, producing 14 units:

According to the graph shown, producing 14 units:

A. will earn more profits than producing 9 or 11 units. B. will earn zero profit. C. is not as profitable as producing 11 units. D. will earn negative profits.