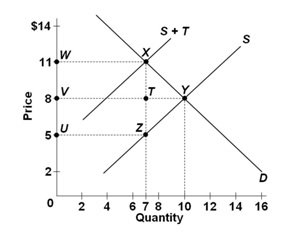

Refer to above figure. What is the amount of government revenue resulting from imposition of the tariff?

What will be an ideal response?

$120

You might also like to view...

Refer to Goods X and Y. Which of the following can cause a parallel, outward shift in the budget line?

Assume that good X is on the horizontal axis and good Y is on the vertical axis in the consumer-choice diagram. PX denotes the price of good X, PY is the price of good Y, and I is the consumer's income. Unless otherwise stated, the consumer's preferences are assumed to satisfy the standard assumptions. a. A rise in the consumer's income. b. A rise in the marginal value of X in terms of Y. c. A fall in the price of good X. d. A fall in the price of good Y.

A negative shock in aggregate demand will likely result in no permanent change in ________

A) output B) the equilibrium inflation rate if the central bank responds by lowering interest rates C) aggregate demand, if the central bank responds by lowering interest rates D) all of the above E) none of the above

Which of the following is NOT a determinant of the price elasticity of demand?

A. the share of the budget spent on the item B. the time the consumer has to adjust to the price change C. the availability of potential substitutes D. the cost to produce the product

Refer to the below graph. How much is the efficiency (or deadweight) loss due to the excise tax?

The graphs below illustrate the market for a product on which an excise tax has been imposed by government.

A. $6

B. $9

C. $18

D. $21