Discuss the effects of a rise in the interest rate paid by euro deposits on the exchange rate

What will be an ideal response?

There are two effects to consider. If we make the unrealistic assumption that the expected exchange rate will not change, then a rise in the interest rate paid by Euro deposits causes the dollar to depreciate. However, if the expected exchange rate were to rise, then the current exchange rate would also rise. (See Figure 14-6 from the text.)

You might also like to view...

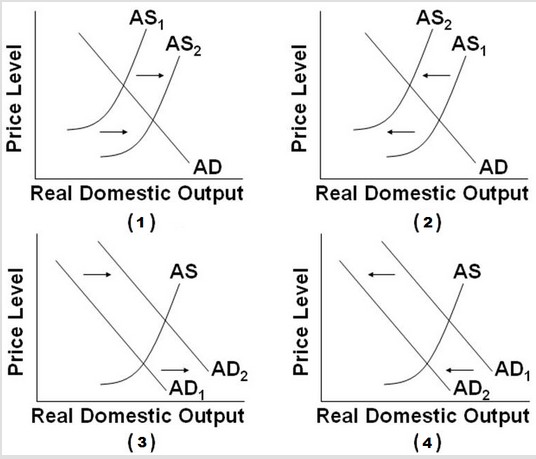

Use the following diagrams for the U.S. economy to answer the next question. Which of the diagrams best portrays the effects of an increase in foreign spending on U.S. products and an expansion?

Which of the diagrams best portrays the effects of an increase in foreign spending on U.S. products and an expansion?

A. Graph (1) B. Graph (2) C. Graph (3) D. Graph (4)

Bank reserves will decrease if

A) Fed liabilities decrease. B) currency held by the public decreases. C) float decreases. D) Fed assets increase.

If an economy is producing inefficiently, it is

a. possible to increase production of all goods simultaneously. b. possible to increase production of one good at the expense of another. c. not possible to increase production of any good. d. not possible to increase economic growth. e. possible to increase production with no effort.

The three problems with determining whether an equal income distribution is fair include all of the following except:

A. income differences and wealth differences are not the same. B. people's efforts differ. C. people don't start from equivalent positions. D. people's needs differ.