The Sting Company began operations at the beginning of 2018 and had GAAP (book) income of $350,000 and taxable income of $280,000. During 2018, depreciation expense for tax purposes exceeded GAAP (book) depreciation expense by $210,000, while warranty expense for GAAP (book) purposes exceeded warranty expense for tax purposes by $140,000. These two temporary differences will reverse as follows: Depreciation Warranty2019$35,000 70,000 2020 70,000 56,000 2021 105,000 $14,000 The enacted income tax rate for 2018 and 2019 is 38%, while the enacted income tax rate for 2020 and 2021 is 40%. Sting did not make any income tax payments during 2018. Requirement:Prepare the journal entry to record income tax expense for the year ended December 31, 2018.

What will be an ideal response?

| December 31, 2018 | Income tax expense | 135,100 | |||

| Deferred tax asset | 54,600 (1) | ||||

| Deferred tax liability | 83,300 (2) | ||||

| Income tax payable | 106,400 (3) |

(2) ($35,000 × 0.38) + ($70,000 × 0.40) + ($105,000 × 0.40)

(3) ($280,000 × 0.38)

You might also like to view...

This question contains two parts; be sure to answer both. First, describe the relationship between the amount of conflict in a department or organization and that department or organization's performance. At what level of conflict is performance maximized? Second, suppose that you are the manager of a store that sells medical supplies for the handicapped or infirm. You see three major sources of conflict at the store: (1) many of the staff members who work the front desk do not like one another, (2) those who stock the shelves and work with the customers are resentful that they are not paid more, and (3) all employees are required to work nights and weekends, which cuts into their family and personal time. Explain how you would manage each source of conflict.

What will be an ideal response?

What is meant by labor-management partnerships and what challenges do they pose for unions?

What will be an ideal response?

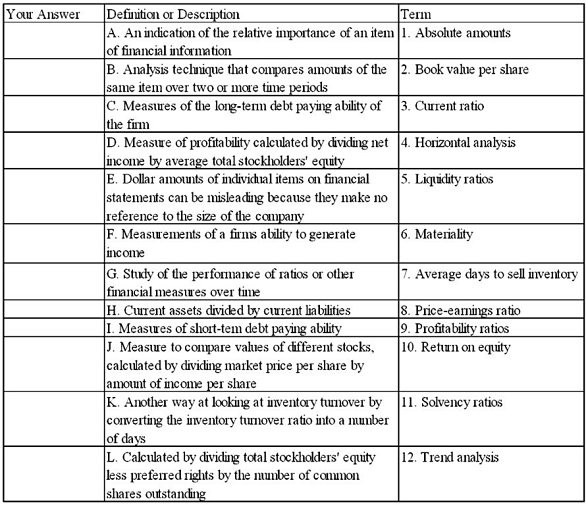

Select the term from the list provided that bests matches each of the following descriptions or definitions:

What will be an ideal response?

During September, Ferman Clinic budgeted for 3,800 patient-visits, but its actual level of activity was 4,100 patient-visits. The clinic uses the following revenue and cost formulas in its budgeting, where q is the number of patient-visits:Revenue: $21.60qPersonnel expenses: $22,600 + $6.60qMedical supplies: $1,000 + $2.60qOccupancy expenses: $6,000 + $0.90qAdministrative expenses: $4,300 + $0.30qRequired:Prepare the clinic's flexible budget for September based on the actual level of activity for the month.

What will be an ideal response?