In 2003, Congress passed a substantial cut in income taxes. The Federal Reserve also lowered interest rates. How can these two actions be categorized?

A) Both actions can be categorized as fiscal policy.

B) Both actions can be categorized as monetary policy.

C) The tax cut can be categorized as monetary policy and the lowering of interest rates can be categorized as fiscal policy.

D) The tax cut can be categorized as fiscal policy and the lowering of interest rates can be categorized as monetary policy.

Ans: D) The tax cut can be categorized as fiscal policy and the lowering of interest rates can be categorized as monetary policy.

You might also like to view...

Assume the federal government raises taxes (a contractionary fiscal policy). If the tax increase affects AS and AD equally, then real GDP will ________ and the price level will ________

A) decrease; decrease B) increase; be unchanged C) increase; increase D) decrease; be unchanged E) increase; decrease

Autonomous determinants of consumption expenditures are dependent on the level of current disposable income

a. True b. False Indicate whether the statement is true or false

Some economists reject the idea that bigness is __________. These people believe our policy should be __________

a. c, d, and e b. efficient or technologically superior; to encourage bigness c. inevitable; to break big firms up d. contestable; to contest bigness e. inevitable; laissez-faire

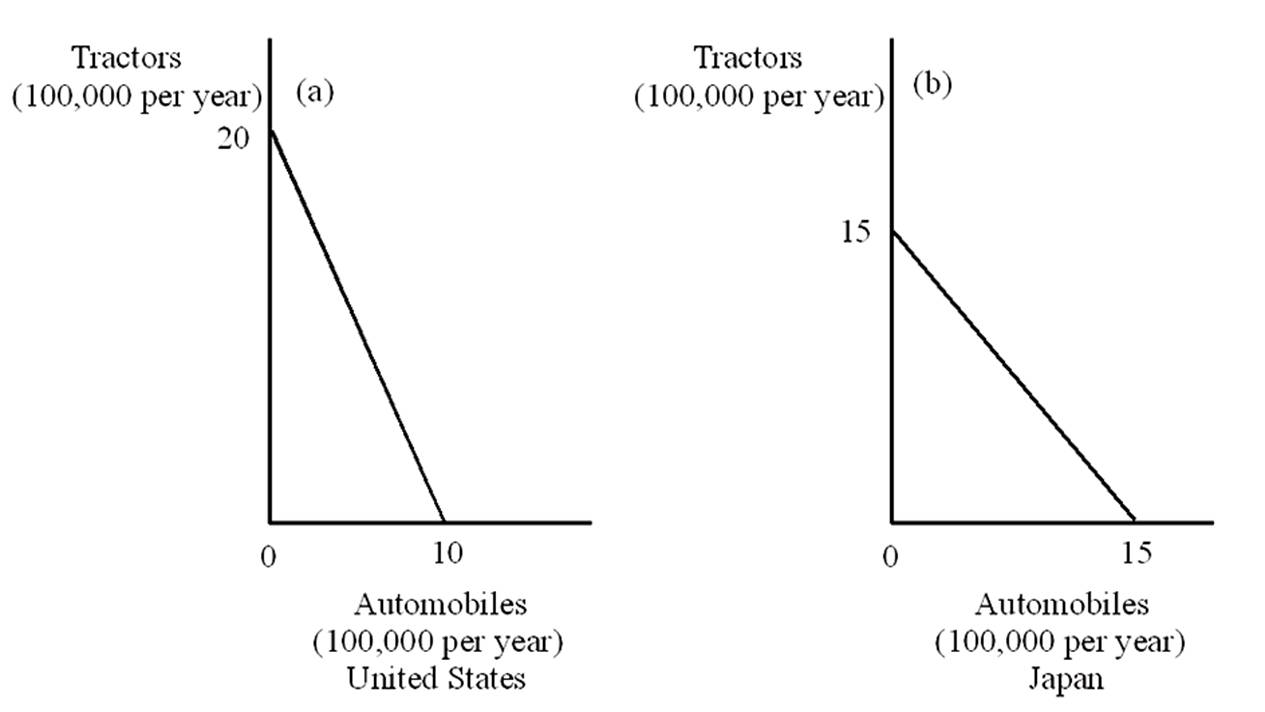

What is the opportunity cost of 1 tractor in terms of automobiles for the U.S. and Japan, respectively?

A. 0.5 automobiles and 2 automobiles

B. 0.5 automobiles and 1 automobile

C. 2 automobiles and 1 automobile

D. 2 automobile and .25 automobiles