If Bulgaria, for instance, wished to keep its exchange rate with the dollar fixed, what monetary policy options are available to lower unemployment in the short run?

a. Bulgaria has all the options available to it, because domestic monetary policy is conducted inside the nation and has no bearing on its international variables.

b. Traders would realize that any monetary policy actions taken inside a nation would improve economic conditions without affecting international variables.

c. Bulgaria cannot use any monetary policy that would cause its short-run exchange rate to depreciate against the dollar.

d. Bulgaria's monetary action would restore confidence and help keep its currency stable.

Ans: c. Bulgaria cannot use any monetary policy that would cause its short-run exchange rate to depreciate against the dollar.

You might also like to view...

Among the groundbreaking contributions to economics made by John Maynard Keynes is

A) the insight that recessions can result from a lack of aggregate demand. B) the development of the spending multiplier. C) the theory of sticky wages and prices. D) all of the above

All of the following are examples of normative statements EXCEPT:

A. Low unemployment is more desirable than low inflation. B. High rates of economic growth are preferable to low rates. C. Output per person should increase at an average annual rate of 5 percent. D. Output per person typically grows more slowly than output per worker.

Suppose that when the price per ream of recycled printer paper rises from $4 to $4.50, the quantity demanded falls from 800 to 600 reams per day. Using the midpoint formula, what is the price elasticity of demand (in absolute value) over this range?

A) 0.003 B) 0.41 C) 2.43 D) 4

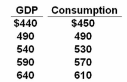

Refer to the above table. If a government sector is introduced and a lump-sum tax of $30 billion is imposed at all levels of GDP, then the consumption column in the table becomes:

The data below is the consumption schedule in an economy. All figures are in billions of dollars.

A. $420, 460, 500, 540, 580

B. $426, 466, 506, 546, 586

C. $430, 470, 510, 550, 590

D. $432, 472, 512, 552, 592