Which of the following is false?

a. If the Fed wants to expand the money supply, it could lower the discount rate

b. The discount rate is a relatively unimportant monetary policy tool, mainly because member banks do not rely heavily on the Fed for borrowed funds.

c. Changes in required reserve ratios are such a potent monetary policy tool that they are frequently used.

d. If the Federal Reserve wanted to induce monetary expansion, it could reduce reserve requirements, but it cannot force the banks to make loans, thereby creating new money.

c

You might also like to view...

How does an increase in interest rates affect net exports?

What will be an ideal response?

The reserve ratio is 20 percent. If the Fed buys $1 million of U.S. government securities and the check is deposited in Bank A, but Bank A increases its vault cash by the entire amount, then the money supply

A) does not increase. B) increases by $800,000. C) increases by $1 million. D) increases by more than $1 million.

The economizing problem is essentially one of deciding how to make the best use of

A) unlimited resources to satisfy limited wants. B) unlimited resources to satisfy unlimited wants. C) limited resources to satisfy limited wants. D) limited resources to satisfy virtually unlimited wants.

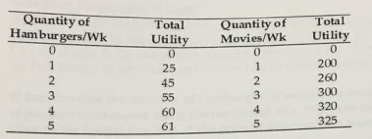

Refer to the above table. Assume the consumer spends his entire income. The price of hamburger is $1, the price of a movie is $6, and the consumer has $15. What is the consumer's optimum?