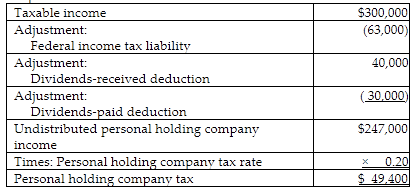

A corporation is classified as a personal holding company. Its taxable income is $300,000 and its regular federal income tax liability is $63,000. The company claims a $40,000 dividends-received deduction and pays $30,000 dividends to its shareholders. The personal holding company tax is

A) $49,400.

B) $62,000.

C) $41,400.

D) $61,400.

A) $49,400.

You might also like to view...

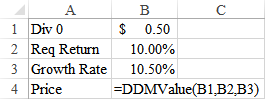

Below is the code for the function DDMValue. What is the outcome in B4?

Public Function DDMValue(Div0 As Single, ReqRate As Single, GrowthRate As Single) As Single

If ReqRate > GrowthRate Then

DDMValue = Div0 * (1 + GrowthRate) / (ReqRate - GrowthRate)

Else

DDMValue = CVErr(xlErrValue)

End If

End Function

a) #VALUE!

b) -$110.50

c) $110.50

d) $55.64

e) $27.34

Honor, a market researcher for a packaged goods company, is segmenting a population of consumers based on how frequently they buy different types of packaged goods. Honor is using behavioral segmentation

Indicate whether the statement is true or false

A company had average total assets of $1,660,000, total cash flows of $1,320,000, cash flows from operations of $205,000, and cash flows from financing of $750,000. The cash flow on total assets ratio equals:

A. 79.5%. B. 45.2%. C. 22.0%. D. 11.65%. E. 12.3%.

"A person, household, or company that over time yields a revenue stream that exceeds by an acceptable amount the company’s cost stream of attracting, selling, and servicing that customer" refers to a?

a. Preferred customer b. Profitable customer c. Positive customer d. Perfect customer