Which of the following is true about exemptions for an individual in a Chapter 7 bankruptcy?

A) Exemptions are always determined by state law.

B) The state exemptions, where present, generally allow the debtor to keep fewer assets than

under federal law.

C) The federal statutory exemptions apply in all cases.

D) The federal law allows states to set their own exemptions, which can be either mandatory

or optional in place of the federal exemptions.

D

You might also like to view...

The allowance method is a technique that attempts to recognize bad debt expense in the same period that the related credit sales are made

Indicate whether the statement is true or false

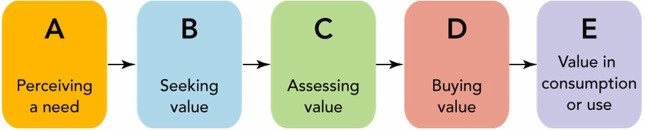

Figure 4-1According to Figure 4-1 above, the point at which you would exchange money for your sandwich of corned beef on rye would be found in stage ________.

Figure 4-1According to Figure 4-1 above, the point at which you would exchange money for your sandwich of corned beef on rye would be found in stage ________.

A. C B. A C. B D. D E. E

________ is a management approach that involves developing strategies that both support the ecological balance and produce profits for the company

A) Consumerism B) Quasi-environmentalism C) Environmental sustainability D) Materialism E) The marketing concept

Which of the following statements are false regarding the numbers generated by the RAND function in Excel®?

a. The numbers are random between 0 and 1. b. The numbers are probabilistically dependent. c. The numbers are probabilistically independent. d. The numbers are uniformly distributed between 0 and 1.