Which of the following statements is false?

A) The Dow Jones Industrial Average went down by 40 percent during the decade of the 1930s.

B) Based on data from the period between 1926 and 2004, the probability of having a positive return on an investment in the stocks contained in the Dow Jones Industrial Average would have been 97.1 percent if the stocks had been held for 10 years.

C) When reading the stock market page of a newspaper, if the column marked "Div." is blank, it means that the company does not currently pay out dividends.

D) A stock that yields 4 percent is better than a stock that yields 5 percent, all else being the same.

D

You might also like to view...

According to Gordon, all of the following are important ingredients in the recent U.S. housing bubble EXCEPT

A) low interest rates. B) saving glut. C) financial innovation. D) trade deficit.

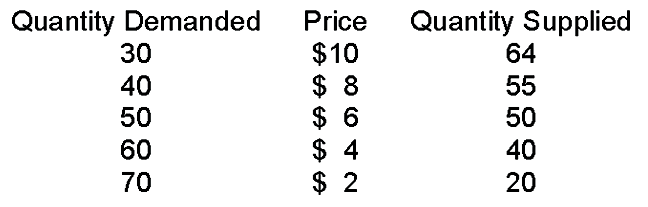

When price is $2

A. there is a surplus.

B. there is a shortage.

C. quantity demanded is less than quantity supplied.

D. price must fall to get to equilibrium.

A company’s ability to pay its debts is measured by:

A. solvency tests. B. profitability tests. C. profitability ratio. D. liquidity ratio.

The total revenue received by sellers of a good is computed by

A. multiplying the price times the quantity sold. B. dividing the percentage change in quantity by the percentage change in price. C. adding the price and the quantity sold. D. multiplying the percentage change in price times the percentage change in quantity.