The 2001 and 2003 tax cuts of the George W. Bush administration each had provisions to

A. lower the earned income tax credit.

B. lower (or speed up the already scheduled lowering) to tax rates.

C. raise tax rates at the lower end.

D. raise tax rates at the upper end.

Answer: B

You might also like to view...

The percentage change in the quantity supplied of a good or service when its price changes by one percent is:

A. price elasticity of supply. B. price elasticity of demand. C. cross-price elasticity. D. income elasticity of supply.

The farmers in Country A harvest and sell 150 tons of rice at the price of $80 per ton. Of the total produced, 30 tons are exported. If the government bans all exports of rice, the domestic price of rice would drop to $60. But the production and sales would also drop to 120 tons. How much loss would the domestic farmers incur due to the export ban? Use a graph to illustrate your answer.

What will be an ideal response?

A(n) ______ subsidy is a subsidy on a good with external benefits.

Fill in the blank(s) with the appropriate word(s).

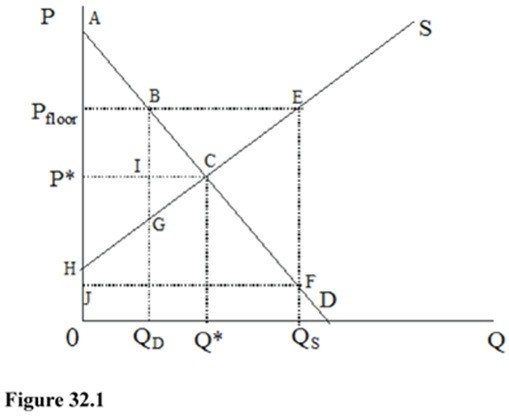

In Figure 32.1, at the market equilibrium price-quantity combination, the total variable cost to producers is

A. 0HGQD. B. 0HCQ*. C. 0ABQD. D. 0HEQS.