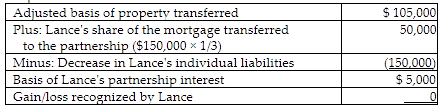

Lance transferred land having a $180,000 FMV and a $105,000 adjusted basis, which is subject to a $150,000 mortgage in exchange for a one-third interest in the Trois Partnership. Lance acquired the land in 2010. The partnership owes no other liabilities. Lance, Rhonda, and Zach share profits and losses equally and each has a one-third interest in partnership capital. The tax effect to Lance is

A) no gain or loss recognized.

B) recognized gain of $45,000 on the transfer.

C) recognized gain of $75,000 on the transfer.

D) recognized loss of $45,000 on the transfer.

A) no gain or loss recognized.

Lance's net debt relief of $100,000 is less than the basis of the asset transferred so no gain is recognized. Loss would not be recognized under Sec. 721.

You might also like to view...

Carpark Services began operations in 20X1 and maintains long-term investments in available-for-sale debt securities. The year-end cost and fair values for its portfolio of these debt securities follows. The year-end adjusting entry to record the unrealized gain/loss at December 31, 20X1 is: Available-for-Sale SecuritiesCost Fair ValueDecember 31, 20X1$250,000 $241,000December 31, 20X2$340,000 $350,000

A. Debit Fair Value Adjustment - Available-for-Sale (LT) $9,000; Credit Unrealized Loss - Equity $9,000. B. Debit Realized Loss - Income $9,000; Credit Fair Value Adjustment - Available-for-Sale (ST) $9,000. C. Debit Fair Value Adjustment - Available-for-Sale (LT) $9,000; Credit Unrealized Gain - Equity $9,000. D. Debit Unrealized Gain - Equity $9,000; Credit Fair Value Adjustment - Available-for-Sale (LT) $9,000. E. Debit Unrealized Loss - Equity $9,000; Credit Fair Value Adjustment - Available-for-Sale (LT) $9,000.

Which of the following is not considered an argument for treating employees as "more" than simply another commodity that can be bought and sold in the labor market?

A. Most modern workers are completely dependent upon jobs, not property, in determining the quality of their life. B. Working adults spend a considerable proportion of their life at work and hence work provides an important social setting that greatly influence quality of life. C. When workers agree to supply their labor in exchange for pay and benefits, they are freely choosing to follow management's directives. D. Workers have feelings and free will that can, if they wish, interfere with the quantity and quality of work they perform.

Elmer agreed to act as the conditional guarantor of collection on a debt of $50,000 that Fred owed to Gloria. Fred paid Elmer a premium to serve as surety. If Fred defaults on the debt, what are Gloria's rights against Elmer?

Identify and describe three dependencies of project activities

What will be an ideal response?