River City Building Supply contracts with Mango Janitorial for their services, but has little control over how the janitorial services are performed. Mango Janitorial is most likely an independent contractor

Indicate whether the statement is true or false

T

You might also like to view...

The AICPA may revoke a member's CPA license for violations of its Code of Professional Conduct

a. True b. False Indicate whether the statement is true or false

Sweet Dreams Corp. has prepared the following financial statements:

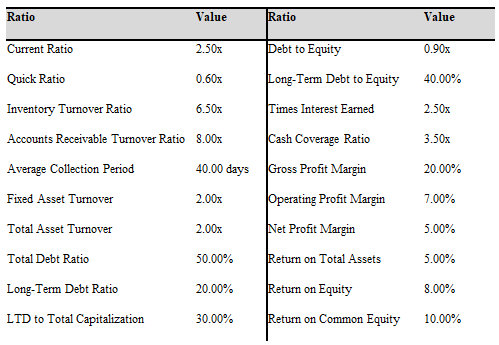

a) Set up a worksheet similar to the one in Exhibit 4-4, page 124, and calculate all of the ratios for Sweet Dreams Corp.

b) Verify the change in 2017 Sweet Dreams Corp’s ROE using the Du Pont method.

c) Using the Altman’s model for privately held firms and public ones, calculate the Z-score for Sweet Dreams Corp. Assume that the market value of Sweet Dreams Corp. is $1,200,000.

d) Calculate Sweet Dreams Corp.’s economic profit for these years and compare it to net income. Assume that the weighted average cost of capital is 12%.

e) Using the following 2017 industry averages, evaluate Sweet Dreams Corp.’s financial situation. Set up a ratio analysis system similar to the one in Exhibit 3-6, page 92.

Under the organizational model of decision-making:

A) Decision makers are not constrained by standard operating procedures B) Decision makers are constrained to be somewhat predictable but create unpredictable outcomes C) Decision makers are constrained by standard operating procedures that tend to make decision outcomes somewhat predictable D) Decision makers are constrained to be somewhat predictable and create predictable outcomes

In year one, McClintock Co. acquired a truck that cost $75,500 with an estimated $14,000 salvage value and 4 year estimated useful life. Depreciation in the first year was $15,375. McClintock had the following transactions involving plant assets during Year 2. Unless otherwise indicated, all transactions were for cash.Jan. 5Paid $5,000 to put a new engine in the truck that is expected to make the truck run more efficiently and increase the truck's useful life by one year. The salvage value did not change.Mar. 1Paid $2,000 to replace a broken tailgate that was damaged when a heavy carton was inadvertently dropped on it.Dec. 31Recorded straight-line depreciation on the truck.Prepare the general journal entries to record these transactions.

What will be an ideal response?