The average investor must weigh the benefits of liquidity against

A) the high taxes generally levied on liquid assets.

B) the lower returns on liquid assets.

C) the high transactions costs involved in disposing of liquid assets.

D) the greater variability in the nominal returns on liquid assets.

B

You might also like to view...

A student wrote: "A subsidy raises marginal social benefit above marginal social cost and eliminates the deadweight loss from underproduction." If you were the instructor, how would you correct this statement?

What will be an ideal response?

Suppose Juliana owns a small business making handbags. Each month she makes 18 handbags, which she sells for $100 each. The materials used to make each handbag cost $50. In addition, Juliana uses a spare room in her house to make the handbags and store her supplies. If she were not using the spare room for her business, she would use it as a guest room, an option that Juliana would value at $250 per month. If Juliana weren't making handbags, she would work at Trader Joe's earning $800 per month. What is Juliana's accounting profit each month?

A. $650 B. $900 C. $750 D. ?$150

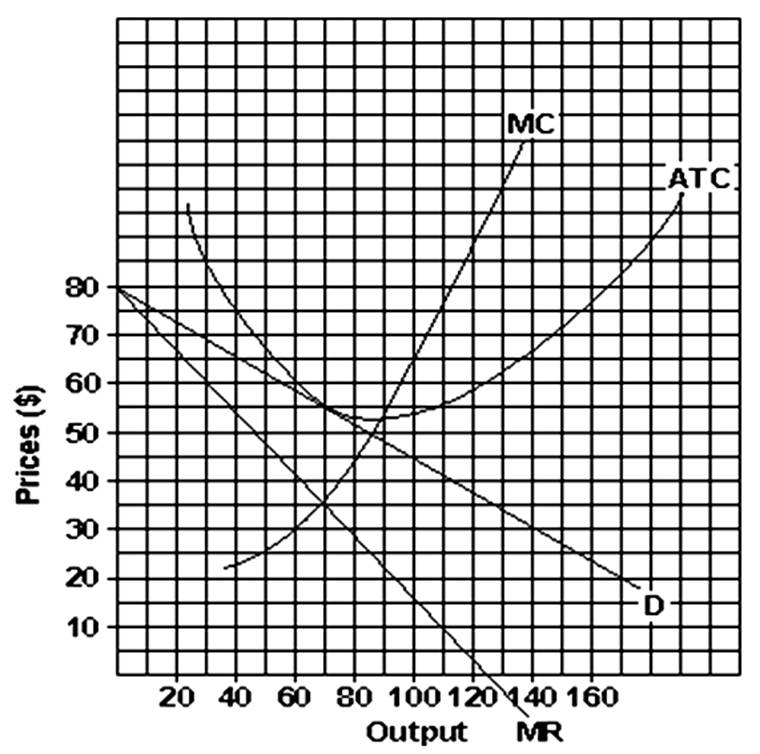

If this firm produced at its most efficient output level it would produce _______ units.

A. 70

B. 80

C. 90

D. 100

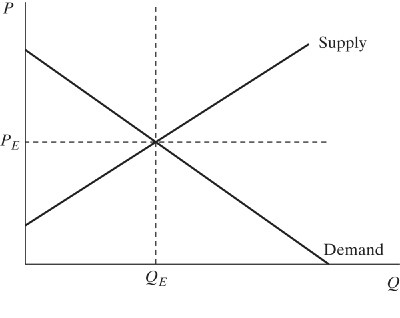

Consider Figure 9.8, which depicts the supply and demand for coal. Assume coal production creates external costs. If the government imposes a pollution tax on coal production, the:

Consider Figure 9.8, which depicts the supply and demand for coal. Assume coal production creates external costs. If the government imposes a pollution tax on coal production, the:

A. supply curve of coal would shift to the left. B. supply curve of coal would shift to the right. C. demand curve for coal would shift to the left. D. demand and supply curves for coal would shift to the left.